Amid an economic and geopolitical slump, sporting goods retailers face significant constraints like all other retail players. Indeed, they have to juggle between logistic uncertainties, supply difficulties, disruptions, and shortage of manpower while containing the increase in the price of products and energy … a rather complicated situation that degrades the profitability of the players. Moreover, the short-term outlook needs to improve and will undoubtedly significantly impact the evolution of volumes.

And to spice things up, let’s add that within this environment, guaranteeing a high level of service and the assurance of an ultra-quality image are not options!

Despite this high level of instability, sporting goods distributors can still count on exploiting growth drivers: major sporting events, opportunities linked to societal trends, investment capacities, innovation in customer experience, etc.

Nevertheless, the context impacts the activity of the points of sale and the organization generally: what are the stakes, and how to respond to them by seizing development opportunities?

Things to remember

- The economic environment for sporting goods distributors will become more intense, with a greater risk of volume attrition in the “lifestyle” segments perceived as “less vital” and specific technical products linked to the development of the second-hand market.

- However, sports retailers have strong levers to meet the challenge:

– major sporting events,

– a digital transformation that is already well underway (in omnichannel, product and technological innovation, and DATA),

- … levers that will require changes in the organization of work, the strengthening of team skills, and the orchestration of activity to advise better and serve customers.

Demand for sporting goods remains strong in an inflationary and competitive environment.

We will not deny it, the cascading consequences of the successive health crises and the war in Ukraine have not spared the sporting goods stores:

- shortages of raw materials and, therefore, of finished products,

- soaring energy prices

- increase in purchasing costs (+7 to 8%) that cannot be fully passed on to the price of goods, which have only “increased by 3.5%” over the first five months of 2022

- lack of carriers and randomness of delivery times

- personnel costs increasing, with a growing workforce and the revaluation of the minimum wage … always on the background of recruitments in forceps

Undoubtedly, the context has improved and is threatening commercial and operational margins.

However, the price increase should still contribute to a 6% growth of the sporting goods market in 2022, reaching a value of 13.1 billion euros!

Indeed, the French craze for sports, especially outdoors, combined with concerns for health, well-being, and the planet, is integral to current lifestyles. Demand is staying strong, especially in segments that have contributed to this trend, such as running, lifestyle, and soft mobility (bicycles, scooters). In 2021, 2.7 million new bicycles were sold in France, including 660,000 electrically assisted bikes!

Now, these figures must be considered with caution. Indeed, the economic context and the drop in purchasing power could affect sportswear, representing 65% of textile sales (40% of sales in value of sports articles) at sporting goods distributors, against 35% for technical articles. And precisely, as far as these specialized products are concerned, the behavior of enthusiasts who need them to practice their sport more naturally favors their acquisition … but the acceleration of the secondary market could attack the segment as part of equipment renewal. The same applies to mobility, which is synonymous with significant investments.

This being said, the multi-universe and multi-brand stores such as Decathlon, Intersport, or GoSport, still have solid cards to play to seize the opportunities and take up the challenges that arise from them, as the point of sale remains the preferred purchasing channel for 63% of consumers. Sporting events, societal evolutions, investment capacities, and innovations in customer experience … there is plenty to fight for!

The commercial challenge of major upcoming sporting events

Soccer World Cup 2022, Rugby World Cup 2023, Paris Olympics, and Euro 2024: sales areas will be decked out in France’s colors. As for the fans, more receptive than ever to the contextualized messages of the brands, they will be there.

In short, it’s going to happen!

Licensed T-shirts, official scarves and balls, branded clothing and footwear sponsoring athletes, new vocational equipment … specific sectors and product families will be in high demand, and a substantial increase in traffic at the point of sale can be expected. Advisors will be in tall order and may have to give more of themselves than usual, as such events create a bubble of belonging and connivance. And the presence and presentation of the coveted products are essential. In that case, the availability of employees who are specialists in their sport and willing to discuss the daily performances of the competitors is just as important.

Considering the abovementioned difficulties, the challenge is as strong as a heavyweight weightlifter.

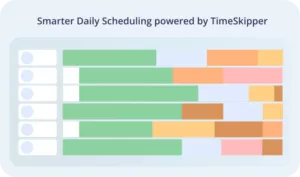

Indeed, it is necessary to anticipate the workload linked to the increased volumes of the activities impacted by the events, such as shelving, animations, or sales advice. On the other hand, it is necessary to know how to distribute it fairly according to the people present while guaranteeing the image’s quality and the store’s daily management. And there, we are immediately a little less happy about the practical side, … but the solutions exist!

The impact of behavioral and societal changes on the product offering

The various global crises, whether health, economic or political, have accelerated the transformation of new lifestyles and consumption patterns. These have become catalysts for new practices and marked demands: outdoor sports, soft mobility, sustainability, etc. This demand forces certain distributors to review their concepts, diversify their activities and develop new expertise. Still, it also creates markets for hyper-specialization, services, and second-hand products.

Here are a few examples to illustrate our point:

1- The rise of outdoor sports: towards a diversified but specialized market

To meet the new needs and behaviors generated by the explosion of outdoor activities, retailers are expanding their offer by developing related products: food sections (protein powders and bars, energy drinks, etc.), a responsible food line by Patagonia, snowshoes or trail equipment at winter sports retailers established in the mountains (Intersport, Go Sport or Sport 2000, etc.).

The challenge here is to have a thorough knowledge of the products and expertise in their use. As sportsmen and women have very high expectations (equipment performance about the environment, for example), it is in their interest to have sales advice that is up to the task. Hence the need for these brands to offer hyperspecialized advice on specific departments at the right time and to know how to keep the teams busy the rest of the time on multipurpose tasks to control personnel costs.

2- Responsible travel with the unprecedented popularity of bicycles and scooters

3 In the first quarter of 2022, sales of sports equipment, particularly bicycles, increased by 18% compared to the same period in 2021. This improvement has mainly benefited physical stores, with online sales down 14%.

But the soft mobility market requires space and is very time-consuming. And orchestrating the activities related to an expansion of the offer, the acquisition of a brand, the multiplication of sales outlets, or the relocation of assembly centers, for example, can be as perilous as a triple axel dive. Also, measuring the time taken by all tasks to calculate the workload related to mobility, and knowing how to allocate the correct number of hours to carry them out, is imperative to make the activity profitable.

3- Product Sustainability:

In full bloom, the second-hand sports goods market is accompanied by the development of new services with a logic of sustainability. Repairing, refurbishing equipment for renewal, maintenance of equipment, or even additional offers such as insurance … the scope of action of the various service workshops is unlimited.

And distributors would be wrong to deprive themselves of this because beyond responding to a pressing demand, services constitute an undeniable growth lever, which can represent 12 to 20% of the distributor’s turnover!

The players in the sector thus demonstrate a desire to invest in the entire circuit, from the source to the end of the product’s life. In the long term, this commitment to sustainability implies a probable transformation of the volume and profitability, as the renewal of products, needs to be more systematic. Changes in sales areas and back offices, new expertise to be integrated, new ways of working (more autonomy and responsibility) … the transformation has begun, and the challenge is a sporting one … but succeeding in these bets will be an essential competitive advantage in the future!

Increased omnichannelity, product innovation, and the impact of DATA:

Strengthening omnichannel systems for sports brands

Less than five years ago, stores started digitalizing their activity to develop omnichannelity. Today, we can no longer imagine a salesperson not being able to order a product for a customer not in stock or at a point of sale without a Click and Collect counter… it’s a fact that doesn’t prevent the customer journey improvement systems from being ever more efficient.

At Decathlon, for example, RFID technology is fully functional, and has wholly shaped the company’s omnichannel strategy. It represents a sales aid, facilitates the inventory thanks to RFID rackets, and allows a unified stock 100% Cloud. In addition, the company is increasing the number of stores equipped with Quadient-connected automatic lockers for easy and fast order collection.

At the heart of the efficiency of the purchasing process and customer satisfaction, omnichannelity, whatever its level of achievement, is the order of the day more than ever. This requires a seamless delivery flow, drive, click and collect services, and other innovative collection methods to cover all needs…

What’s at stake? The efficiency of the order preparation teams and the usefulness of the hour worked, as the preparation costs are not passed on to the final prices. By controlling these two factors, new delivery slots can be opened up for increased sales and a significant improvement in profitability.

Not easy, but certainly possible with a rigorous method!

Product innovation

Increasing the performance of equipment or textiles is the driving force behind innovation as a trigger for purchasing and a factor for moving upmarket.

It’s as much to say that the brands put the package in the matter!

In this respect, Décathlon has seven R&D centers throughout France, enabling it to constantly innovate on its private-label products in ultra-technical niches such as diving, surfing, or paddling. Similarly, Intersport (Energetics, Protouch, …) and GoSport (Wanabee, Athlitech, …) are committed to developing their brands’ technical and tech to generate traffic in stores and sustain volumes. For their part, the Flagships of brands such as Nike, Adidas, or Lacoste are real innovation laboratories. These ultra-modern outlets, which account for 7% of the market share of specialized retailers, push the phygital experience and personalization to the limit, thus cultivating a powerful brand image with a committed target.

At the heart of the issues: DATA

Sportsmen and women constitute homogeneous and active communities. Many data on production practices and uses are transmitted, notably through shared applications (e.g., Strava for runners) and club membership cards or loyalty programs. In this respect, the challenge of collecting, analyzing, and processing DATA is essential because it has become essential for brands and retailers to know their buyers, their habits, their needs, and their use of sporting goods. Driven by technological innovations, more and more advanced products are being developed, such as connected watches (Garmin, Kalenji, Oncoach, …), which allow following athletes everywhere.

This specific data (sports performance, health indicators, environmental preferences, etc.) is a gold mine. And those who know how to exploit them and adjust their offers with tracking technologies have a massive strike force: the ability to animate communities and better personalize their offers. Decathlon goes far in using customer data: proposing products that might interest them, trying them out, and returning them if they don’t like them. It’s daring, it’s fluid, it’s traced … it builds loyalty, and it engages!

The question is how to effectively implement these levers, which the sporting goods distribution industry has undoubtedly grasped. Indeed, despite the challenging economic context, the sector remains dynamic. Its transformation, already well underway, should be accelerated by the effects of the crises we are experiencing … and the impact on the activity and organization of work will be all the more critical.

The Timeskipper solution has supported specialized retail chains in daily business management for more than ten years. Anticipating and distributing workloads, identifying sources of profitability, hunting down under-utilized hours, sizing teams, and adjusting staffing levels according to variations in activity… Timeskipper has all the features needed to overcome the most complex organizational problems and meet the sector’s specific challenges in the current context… to ensure that your retailer and your points of sale perform well over the long term!